Dhanteras Gold to Alternative Assets: The Rise of AIFs for HNIs

- Introduction

- The Timeless Appeal of Gold on Dhanteras

- Why HNIs Are Rethinking Traditional Investments

- What Are Alternative Investment Funds (AIFs)?

- The Rise of AIFs Among HNIs

- Key Benefits of AIFs for High-Net-Worth Investors

- Conclusion

Introduction

Dhanteras is one of those festivals that spark the desire to buy something new. Be it utensils, silver coins, or that little piece of gold we saw in the store. For generations, the ritual of buying gold or silver has been a non-negotiable tradition. We don't just buy it for the shine, but with the belief that its value will enhance with time.

But here's a thought – Are investments just limited to gold and silver?

In recent years, a growing number of investors, especially HNIs, have started shifting their eyes toward alternative assets that focus not only on preservation but also on higher growth.

That's exactly what we'll explore in this blog.

From the timeless charm of gold to the rising popularity of AIFs, we'll discover why HNIs are rethinking investments – and how you, too, can benefit from these modern avenues.

The Timeless Appeal of Gold on Dhanteras

There are two legendary tales often associated with Dhanteras—the Samudra Manthan and the story of King Hima.

Most of us know the first: the churning of the ocean using Shesh Naag as a rope, which brought forth Amrit and a pot of gold. Accordingly, the tradition of worshipping Goddess Lakshmi is followed.

The second is a folktale of King Hima's son, destined to die from a snakebite on his wedding night. His wife cleverly lit rows of diyas and piled gold and silver at the doorway, keeping him awake with stories. The radiance of the metals and the light kept Yamaraj, the God of Death, and the snake away. Since then, gold and silver have been seen as symbols of protection and prosperity.

Back to the present, in 2024, this belief translated into record sales of over ₹22,500 crore worth of gold and silver. And nearly ₹20,000 crore sales were recorded in gold alone.

Why HNIs Are Rethinking Traditional Investments

For investors, every penny spent comes down to one question: Is the risk worth the proceeds received? And, if an investment carries high market risk, does it really help in building long-term wealth?

To look closely, it has a dicey answer after all. And that's the reason why many High-Net-Worth Individuals (HNIs) are rethinking their choices.

Instead of relying only on gold, equities, or fixed deposits, HNIs are now exploring options that move independently of public markets. In fact, they prefer diversification isn't just about holding different assets, but having the right assets that can protect wealth and grow it simultaneously.

And that's how Alternative Investment Funds (AIFs) are gaining traction.

From private equity, debt funds, venture capital to hedge fund strategies, they have opened doors to opportunities that extend beyond traditional investments.

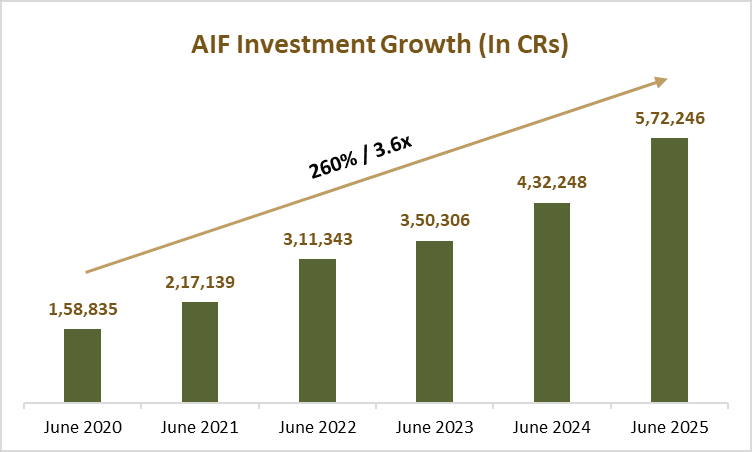

With the recent SEBI report (from Jun 2024 to Jun 2025), the AIFs have grown by 32.4% to ₹5.72 lakh crore in investments made.

What Are Alternative Investment Funds (AIFs)?

In simple terms, Alternative Investment Funds(AIFs) are funds that invest in non-traditional assets like private equity, venture capital, debt funds, or hedging strategies. Their main goal is to offer investment opportunities beyond conventional stocks and bonds, often with higher growth potential.

AIFs are classified into three categories:

- Category I & II:Typically closed-ended funds that focus on socially beneficial ventures, private equity, debt, and real estate.

- Category III: Focuses on trading strategies for listed and unlisted securities, often involving higher risk and more active management.

But also, why only HNIs and not retail investors prefer AIFs is due to their investment limit. With a minimum corpus of ₹1 crore, HNIs have the capacity to direct their savings into these alternative avenues, making AIFs a practical and attractive option for investment.

The Rise of AIFs Among HNIs

In recent years, the Alternative Investment Funds (AIFs) have gained good traction from the HNIs and Ultra HNIs. And one of the major reasons for this growth is the numerous tax and investment opportunities available here. Additionally, many family offices seek long-term investment options with high growth potential.

Moreover, the ability of AIFs to withstand the market stress, provide diversification, and access to expert fund management makes them a preferable option for HNIs.

Source: SEBI

According to recent SEBI data on AIFs, there has been a 3.6 times increase (approximately 260 percent growth) in the past few years. Of which, a major percentage of the investment was visible in the Category II (₹3,48,423 crores), followed by AIF Cat 3, and Cat 1 in Jun 2025.

Key Benefits of AIFs for High-Net-Worth Investors

Alternative Investment Funds provide multiple advantages for high-net-worth investors. It includes;

Here are some of the key Benefits of AIFs for HNI Investors:

Portfolio Diversification

AIFs invest in assets beyond traditional stocks and bonds, like private equity and venture capital. With this variety in the basket, HNIs can spread risk and reduce dependence on market swings.

Access to Unique Opportunities

From private equity, venture capital, to real estate and hedge funds, AIFs offer access to a wide range of unique investment avenues that are not easily accessible to retail investors.

Professional Fund Management

AIFs, by default, have experienced fund managers who bring in-depth market knowledge, research, and investment strategies. Hence, HNIs can easily invest in these options.

Potential for Higher Yields

By focusing on high-growth sectors and hedging strategies, AIFs tend to provide risk-adjusted yields compared to traditional options.

Lower Correlation with Public Markets

Since many AIF investments move independently of stock market trends, they add resilience to an HNI's portfolio.

Customization and Flexibility

Depending on the chosen category, HNIs can choose AIF investments that align with their personal risk appetite, time horizon, and financial goals.

Conclusion

During Dhanteras, gold has always held a special place among the Indians for multiple decades. It is valued not just as tradition but as a trusted store of wealth.

As we have advanced, there has been a shift towards Alternative Investment Funds (AIFs) among HNIs and family offices. They see it as a future that offers growth, diversification, and resilience.

Disclaimer:The information provided in this article is for educational and informational purposes only. Any financial figures, calculations, or projections shared are solely intended to illustrate concepts and should not be construed as investment advice. All scenarios mentioned are hypothetical and are used only for explanatory purposes. The content is based on information obtained from credible and publicly available sources. We do not guarantee the completeness, accuracy, or reliability of the data presented. Any references to the performance of indices, stocks, or financial products are purely illustrative and do not represent actual or future results. Actual investor experience may vary. Investors are advised to carefully read the scheme/product offering information document before making any decisions. Readers are advised to consult with a certified financial advisor before making any investment decisions. Neither the author nor the publishing entity shall be held responsible for any loss or liability arising from the use of this information.